Comprehensive Course Content for Practical GST Return Filing

Unlock the gateway to mastering GST return filing with our Practical GST Return Filing Course. Dive into a wealth of resources and practical experiences meticulously designed to equip you with proficiency in GST return filing. Here's what awaits you upon purchasing our course:

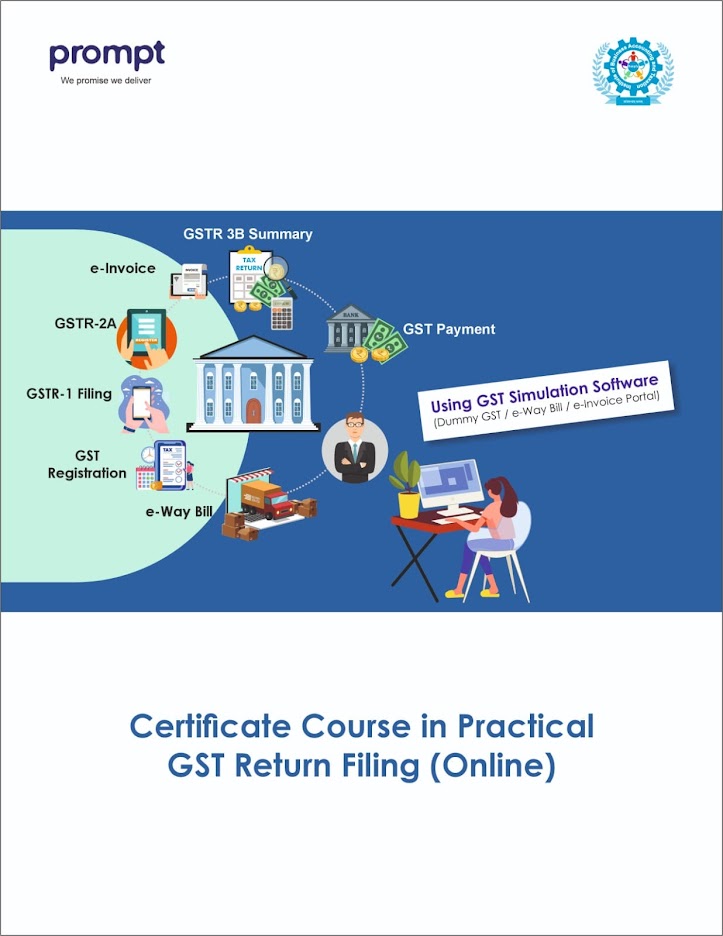

Certificate Course in Practical GST Return Filling

When you purchase our Practical GST Return Filing Course, you'll gain access to a wealth of resources and practical experiences designed to make you proficient in GST return filing. Here’s what you’ll get:

Description

Online GSTR-1 Filing

Master the steps for filing GSTR-1 online, ensuring compliance and accuracy.

Offline GSTR-1 Filing

Utilize Tally JSON files to efficiently file GSTR-1 offline.

Generating GSTR-1 Summary

Understand how to generate and review GSTR-1 summaries.

Auto-Generated GSTR-2A

Get familiar with the auto-generated GSTR-2A and its implications.

GSTR-3B Summary

Learn to compile and understand GSTR-3B summaries.

Filing GSTR-3B using Offline Utility

Gain hands-on experience in filing GSTR-3B through offline utilities.

Generating GSTR-3B Preview

Preview GSTR-3B to ensure all details are accurate before submission.

Generating GSTR-3B Challan

Learn to generate GSTR-3B challans for payment processing.

Payment of Tax

Understand the process of paying taxes through the GST portal.

Viewing Auto-Populated Data for GSTR-2B

Learn to view and verify auto-populated data for GSTR-2B.

Quarterly Return Filing

Get trained in filing quarterly GST returns.

GST – Nil Return Filing

Understand the process and importance of filing nil returns.

GST Registration for Pvt. Ltd. Companies

Navigate the specifics of GST registration for private limited companies.

Excess Purchase – No GST Payment

Learn the scenarios where no GST payment is required due to excess purchases.

GST Amendments

B2B Invoices

Learn how to correct B2B invoices.

Edit Invoice Number

Edit and correct invoice numbers as needed.

Edit Invoice Value

Adjust invoice values accurately.

Edit GST Number

Correct GST numbers to ensure compliance.

E-Way Bill Registration

Learn how to register on the government portal for E-Way Bills using our Simulation Software (Dummy E-Way Bill Portal).

Login Process

Understand the process of logging into the GST portal for E-Way Bill management.

Single E-Way Bill Uploading

Understand the process of uploading a single E-Way Bill.

Bulk E-Way Bill Uploading

Master bulk uploading using Json File.

Viewing / Downloading / Printing E-Way Bill

Explore options for accessing and managing E-Way Bills.

Cancellation of E-Way Bill

Learn the steps to cancel an E-Way Bill.

E-Invoice Registration Process

Gain insights into registering for E-Invoices on the government portal through Simulation Software (Dummy E-Invoice Portal).

Generating Single E-Invoice

Learn how to generate a single E-Invoice seamlessly.

Generating Bulk E-Invoice

Discover the process of generating bulk E-Invoices with the assistance of Json File.

Viewing / Downloading / Printing E-Invoice

Access, download, and print E-Invoices effortlessly.

Cancellation of E-Invoice

Understand the procedure for canceling an E-Invoice.

Enroll now and embark on a journey towards professional mastery!

Enroll Now and seize the opportunity to elevate your accounting skills to new heights!

Benefits

What Student Will Get?

Separate Login ID

Upon enrollment, each student will receive a unique login ID, granting them exclusive access to our comprehensive course materials and resources online.

Video Tutorials and Assignments

Gain access to a wealth of knowledge through our extensive library of video tutorials covering all aspects of GST return filing. Engage with practical assignments designed to reinforce your learning and enhance your understanding of key concepts.

Hands-On Practical Using Simulation Software

Immerse yourself in practical learning experiences with our state-of-the-art simulation software. Navigate through a dummy GST portal that replicates real-world scenarios, allowing you to apply your knowledge in a risk-free environment.

Digital Verifiable Internship Certificate

Upon successful completion of the course, receive a prestigious digital internship certificate. This certificate serves as a testament to your expertise in GST return filing and enhances your credibility in the industry.